Setting up automatic payments is now essential for businesses offering subscriptions or ongoing services. Understanding Stripe automatic payments helps you maintain predictable revenue and keep your billing operations running smoothly.

Stripe provides a full suite of tools to simplify recurring payments. From setting up subscription models to managing failed transactions, it covers everything businesses need to stay on track.

In this guide, we will show you how Stripe automatic payments can simplify billing, support recurring revenue, and make managing customer payments easier.

Understanding Stripe’s Automatic Payment Features

Stripe automatic payments are at the center of these tools, giving businesses flexibility and automation they can trust. Here are the key ones you should know about.

1. Stripe Billing

Stripe Billing is the core of managing recurring payments with Stripe. It supports subscription models, recurring invoices, usage-based billing, and more. Whether you are billing customers monthly, annually, or based on their usage, Stripe Billing can handle it.

We often recommend Stripe Billing to marketplace owners. In our experience, it minimizes billing errors and makes it easier to accept recurring payments without needing complicated setups.

2. Stripe Subscription API

For businesses needing more flexibility, Stripe’s Subscription API allows you to create subscriptions programmatically. This approach is ideal if you want to customize the billing experience without building an entire billing system from scratch.

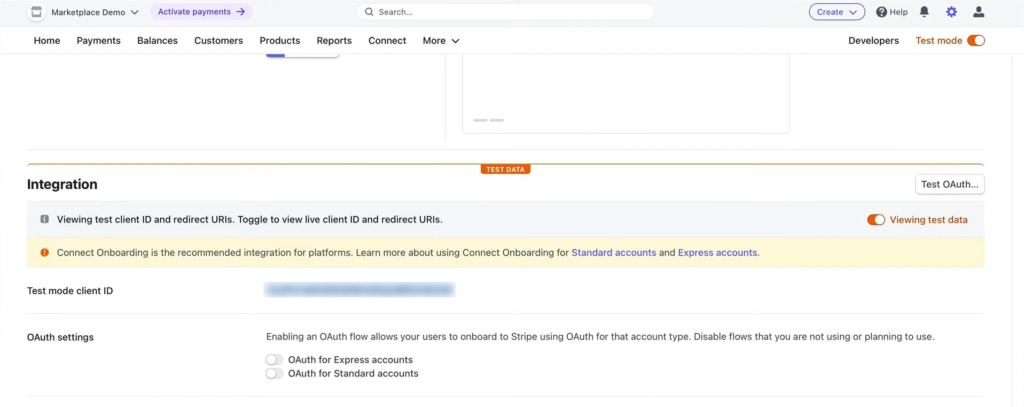

3. Stripe Connect

Running a multi-vendor platform? Stripe Connect makes it simple to manage payouts. It lets you split payments automatically between your vendors and your platform.

Our experience shows that using Stripe Connect to automate recurring vendor commissions reduces payment disputes and helps marketplaces grow faster.

How To Set Up Recurring Payments With Stripe

Setting up recurring billing in WooCommerce using Stripe involves integrating the Stripe payment gateway and configuring subscription products. Here’s a step-by-step guide:

1. Install and Activate the Required Plugins

- WooCommerce Stripe Payment Gateway: This free plugin allows you to accept payments via Stripe. Install and activate it from the WordPress plugin repository.

- WooCommerce Subscriptions: This premium extension enables recurring payments and subscription management. Purchase, install, and activate it from the WooCommerce marketplace.

Note: Ensure both plugins are up to date to maintain compatibility and security.

2. Configure Stripe in WooCommerce

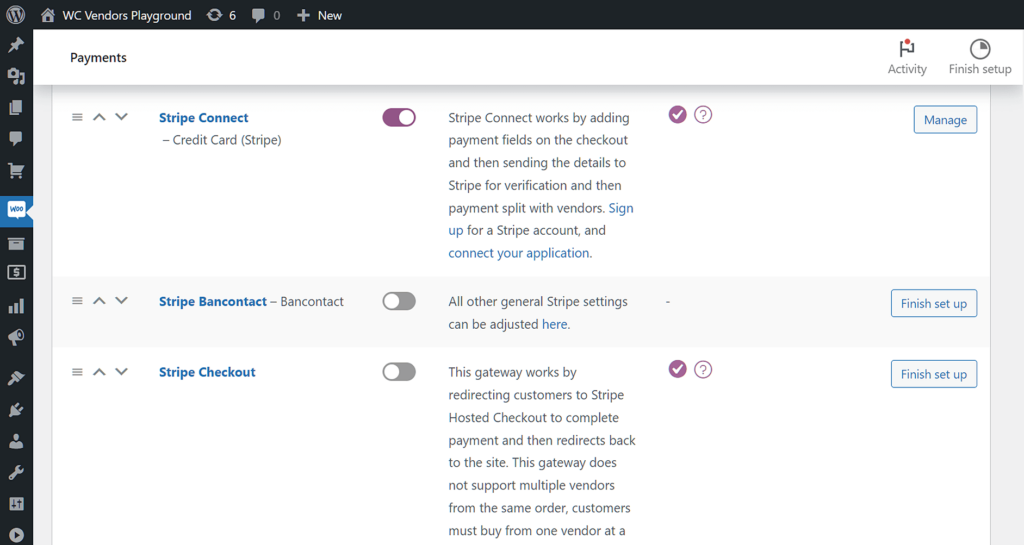

- Navigate to WooCommerce > Settings > Payments.

- Locate Stripe and click Set up or Manage.

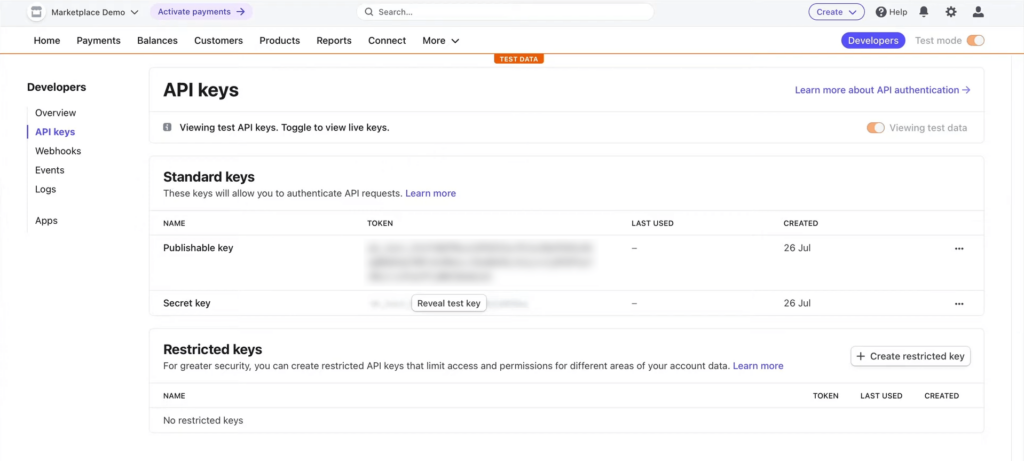

- Enter your Stripe API keys, which you can find in your Stripe Dashboard under Developers > API keys.

- Enable Webhooks in Stripe to allow communication between Stripe and your WooCommerce store. This ensures subscription events (like renewals or cancellations) are properly handled.

- Save changes.

3. Create a Subscription Product

- Go to Products > Add New in your WordPress dashboard.

- Enter the product name and description.

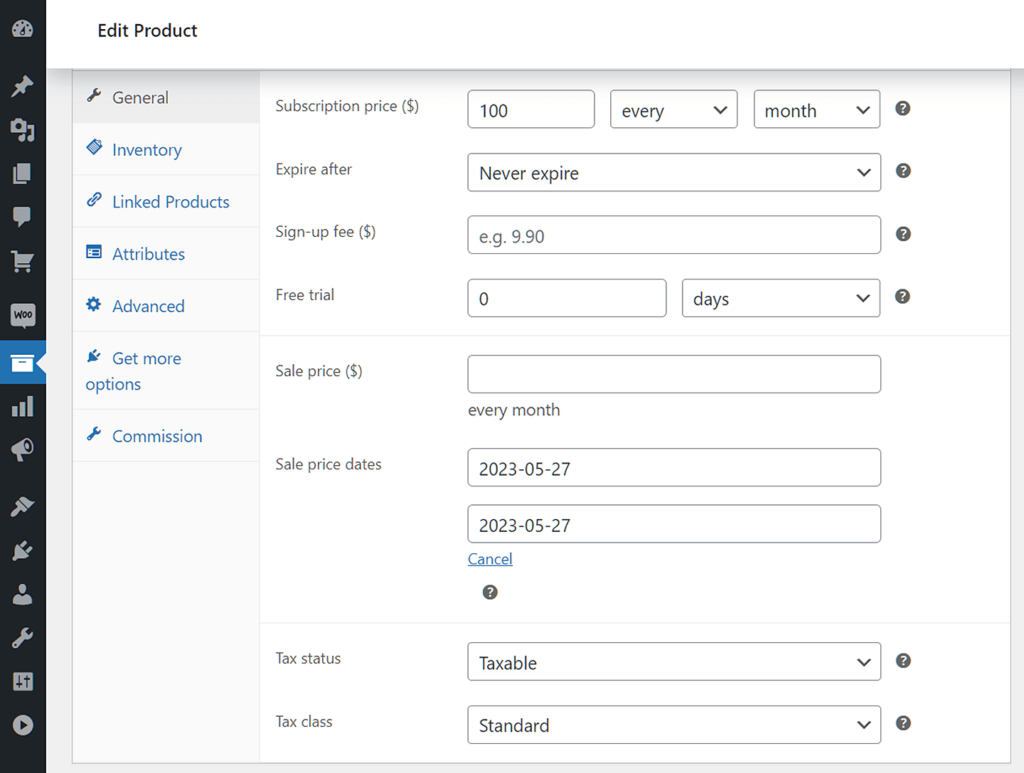

- In the Product data section, select Simple subscription or Variable subscription from the dropdown.

- Set the subscription price, billing interval (e.g., every month), and subscription length (e.g., ongoing or fixed number of payments).

- Optionally, add a sign-up fee or free trial period.

- Publish the product.

4. Test the Subscription Process

Before going live, it’s crucial to test the subscription process:

- Enable Test Mode in the Stripe settings within WooCommerce.

- Use Stripe’s test card numbers to simulate transactions.

- Place a test order for the subscription product to ensure the checkout, payment, and subscription creation processes work smoothly.

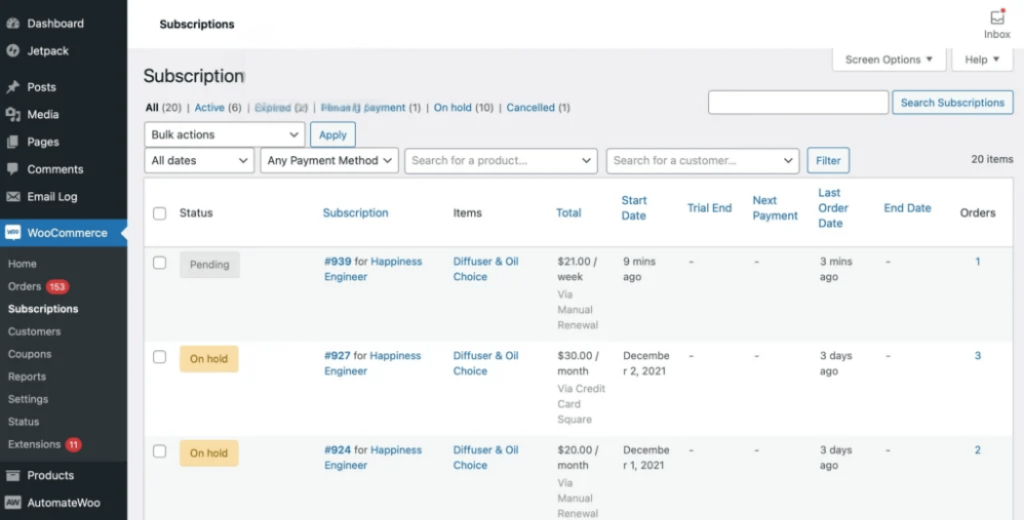

- Verify that the subscription appears correctly under WooCommerce > Subscriptions.

- Once testing is successful, disable Test Mode to start accepting real payments.

5. Monitor and Manage Subscriptions

- Access WooCommerce > Subscriptions to view and manage all active subscriptions.

- Here, you can see details like the subscriber’s name, subscription status, next payment date, and more.

- You can also manually suspend, cancel, or change subscription details as needed.

By following these steps, you can effectively set up and manage recurring payments in your WooCommerce store using Stripe.

This setup ensures a seamless experience for both you and your customers, facilitating consistent revenue through subscriptions.

Managing Vendor Commissions With Stripe Connect

Marketplaces have additional challenges, especially when it comes to paying vendors. You do not want to manually split every payment.

Stripe Connect handles this through embedded payments and finance features. It lets you:

- Split each sale between your platform and the vendor.

- Manage one-time sales and recurring payments the same way.

- Set automated payout schedules.

By automating commissions, you not only save time but also create a better experience for your vendors. Vendors appreciate fast and predictable payouts, and it keeps your platform’s finances clean and transparent.

Handling Failed Payments And Protecting Revenue

Failed payments happen more often than you think. Cards expire. Customers forget to update their billing details.

Stripe automatic payments provide some simple but effective tools to help you recover:

- Smart Retries automatically attempt failed transactions at better times.

- Dunning emails remind customers to update their payment details.

- Payment Intents track the entire transaction process and help avoid common errors.

Managing failed payments protects your revenue. It also helps you keep customers active by giving them chances to update their information before losing access to services.

Recovering even a few failed payments each month adds up. In fact, according to Stripe’s internal data, businesses that use Smart Retries recover about 10 percent more revenue on average.

Staying PCI Compliant With Stripe

PCI compliance can be complicated if you process payments yourself. Fortunately, Stripe automatic payments help simplify it.

When you use hosted tools like Stripe Checkout or Elements, customer payment information never touches your servers. This keeps your PCI DSS compliance scope much smaller.

Stripe also provides a pre-filled SAQ A (Self-Assessment Questionnaire) to help businesses using their hosted solutions stay compliant.

It is still important to follow best practices when managing customer data. But Stripe’s built-in security and encryption tools do most of the heavy lifting, which lets you focus on running your business instead of worrying about audits.

If you want to learn more about PCI compliance standards, you can visit the official PCI Security Standards Council.

Stripe Automatic Payments For Multi-Vendor Marketplaces

If you are running a multi-vendor marketplace, Stripe automatic payments become even more valuable.

Using Stripe Connect, you can split payments between your vendors and your platform automatically. This saves time, reduces manual errors, and makes your marketplace finance operations run smoothly.

At WC Vendors, we have seen first-hand how much easier Stripe Connect makes managing recurring vendor commissions. It ensures that payouts happen on time while giving you full control over platform fees and revenue.

If you want a more detailed walkthrough on setting up and testing Stripe payments in a marketplace environment, check out our guide: How to Test Stripe Marketplace Payments.

You can also explore how WC Vendors integrates directly with Stripe Connect by reading our Stripe Connect Integration Guide. It covers everything you need to get started, including setup steps, payout configuration, and tips for ongoing management.

Setting up Stripe automatic payments correctly in your marketplace gives vendors a better experience and strengthens the foundation of your business.

Conclusion

Stripe automatic payments are not complicated to set up. They are designed to support businesses that want to grow their recurring revenue without spending hours managing billing cycles.

By understanding Stripe’s core tools, setting up products and pricing, handling vendor commissions, and preparing for failed payments, you will create a billing system that supports your growth long-term.

To help you get everything set up properly, here is a quick recap of what you need to remember:

- Understanding Stripe’s Automatic Payment Features

- How to Set Up Recurring Payments with Stripe

- Managing Vendor Commissions with Stripe Connect

- Handling Failed Payments and Protecting Revenue

- Staying PCI Compliant with Stripe

- Stripe Automatic Payments for Multi-Vendor Marketplaces

If you are ready to get started, Stripe’s official Payments Documentation is a great place to dive deeper into the setup.

Stripe makes accepting recurring payments feel less like a technical headache and more like a natural part of your business growth.

Frequently Asked Questions

What happens if a customer’s card is declined during a recurring Stripe payment?

If a customer’s card is declined during a recurring payment, Stripe will automatically trigger smart retries based on its recovery algorithm. It will also notify the customer to update their payment method, helping you recover potential lost revenue without needing manual intervention.

Does Stripe support multiple payment methods for recurring billing?

Stripe supports a wide range of payment methods for recurring billing, including credit cards, debit cards, ACH debits, Apple Pay, Google Pay, and even local payment methods depending on your region. This flexibility improves conversion rates for subscription-based businesses.

How secure are recurring payments processed through Stripe?

Recurring payments processed through Stripe are highly secure. Stripe is certified PCI Service Provider Level 1, the highest level of certification available. It uses tokenization, encryption, and strict compliance protocols to protect customer payment data.

Can vendors in a multi-vendor marketplace manage their own recurring products with Stripe?

Yes, if you use a plugin like WC Vendors combined with Stripe Connect and WooCommerce Subscriptions, vendors can create and manage their own recurring subscription products. They can control pricing, billing intervals, and trial periods independently from the main platform admin.