Taxes in a marketplace can be complicated and differ from country to country. WC Vendors offers two main ways to handle taxes for both the marketplace owner and vendors. The option you choose depends on your country and its tax requirements.

Tax Options in WC Vendors

You can set up taxes in one of the following ways:

- WooCommerce Tax Rate Tables – Add your own tax rates manually.

- Automatic Tax Rates – Use services like TaxJar or Avalara to calculate taxes automatically.

WC Vendors Tax Configuration

In WC Vendors, you must choose if the collected taxes are:

- Given to vendors – Added to their commission records in the Commissions table.

- Kept by the marketplace – The marketplace owner keeps the tax amount.

Note:

WC Vendors does not currently support splitting taxes between the vendor and marketplace. It must go entirely to one or the other.

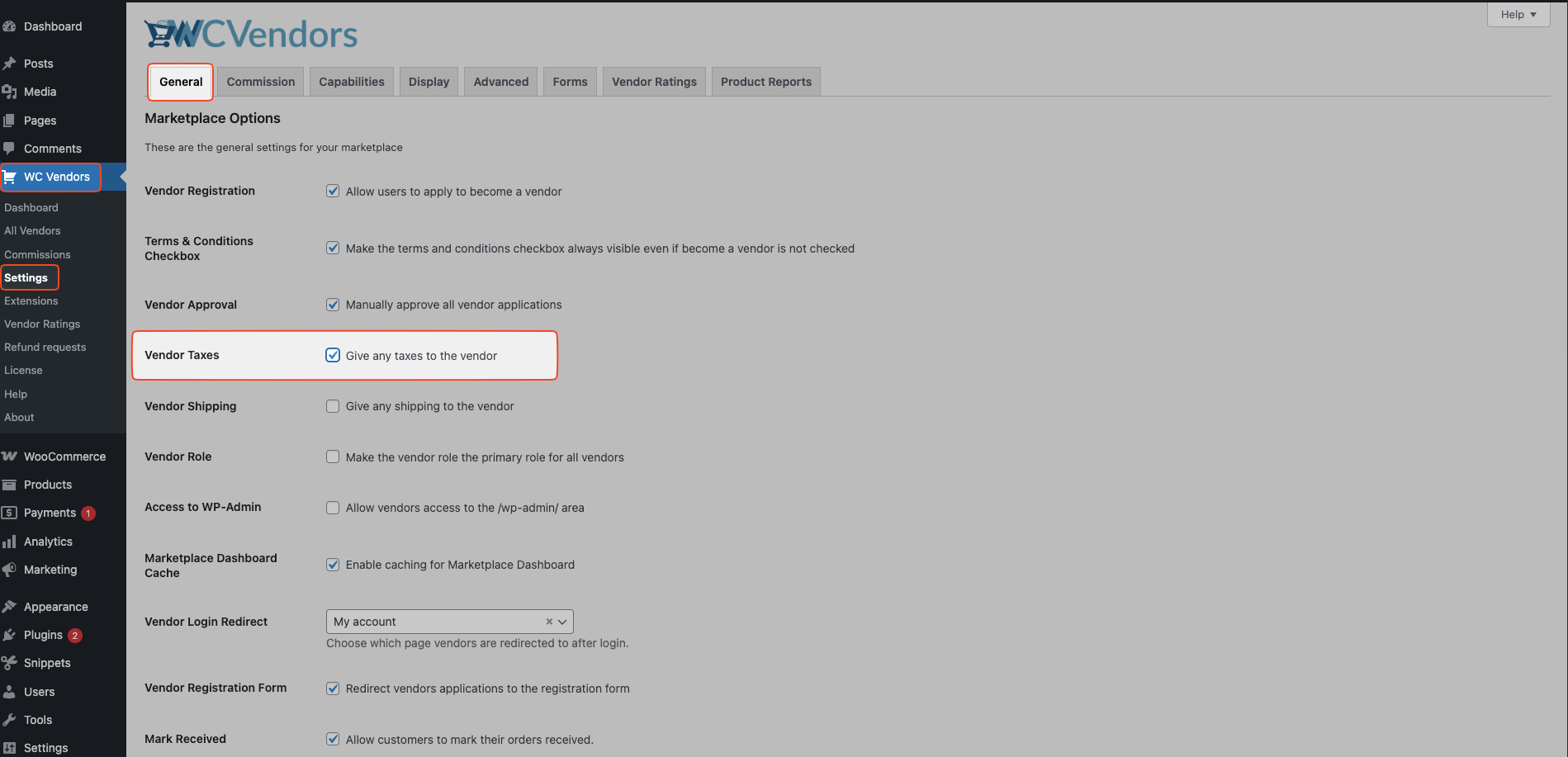

To configure this option:

- Go to WC Vendors > Settings > General.

- Set who will receive the taxes.

This option setting will determine if the taxes are given to the vendors and added to their commission entries in the Commissions table.

WooCommerce Tax Rates

If your country has simple tax rules, you can use the built-in WooCommerce tax system. This allows you to create tax rates that apply to all marketplace products.

Important:

WooCommerce tax rates do not support different tax calculations based on vendor addresses. It assumes the marketplace address and the vendor address are the same for tax purposes.

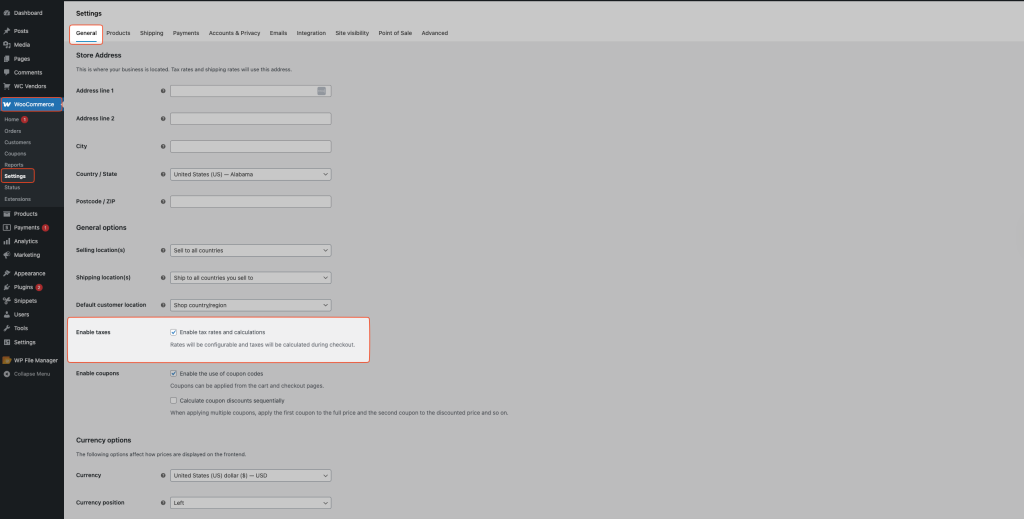

How to Enable Taxes in WooCommerce

- Go to WooCommerce > Settings > General.

- Check Enable Taxes and Tax Calculations.

- Click Save changes.

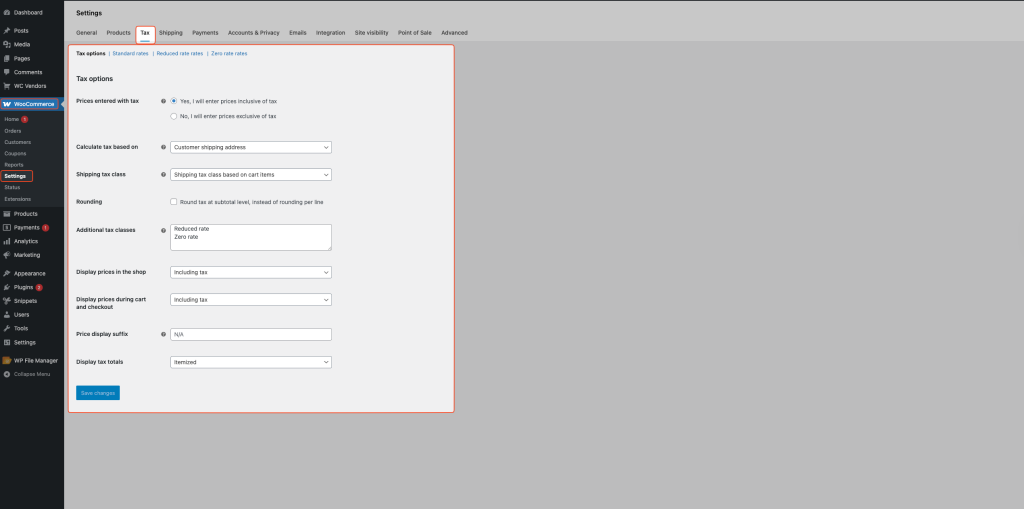

How to Configure Tax Settings

Once taxes are enabled:

- Go to WooCommerce > Settings > Tax (the Tax tab will now appear).

- Adjust the tax settings according to your country’s rules.

- These settings will apply to all products on the marketplace.

You can read more details about these settings on the WooCommerce documentation site.

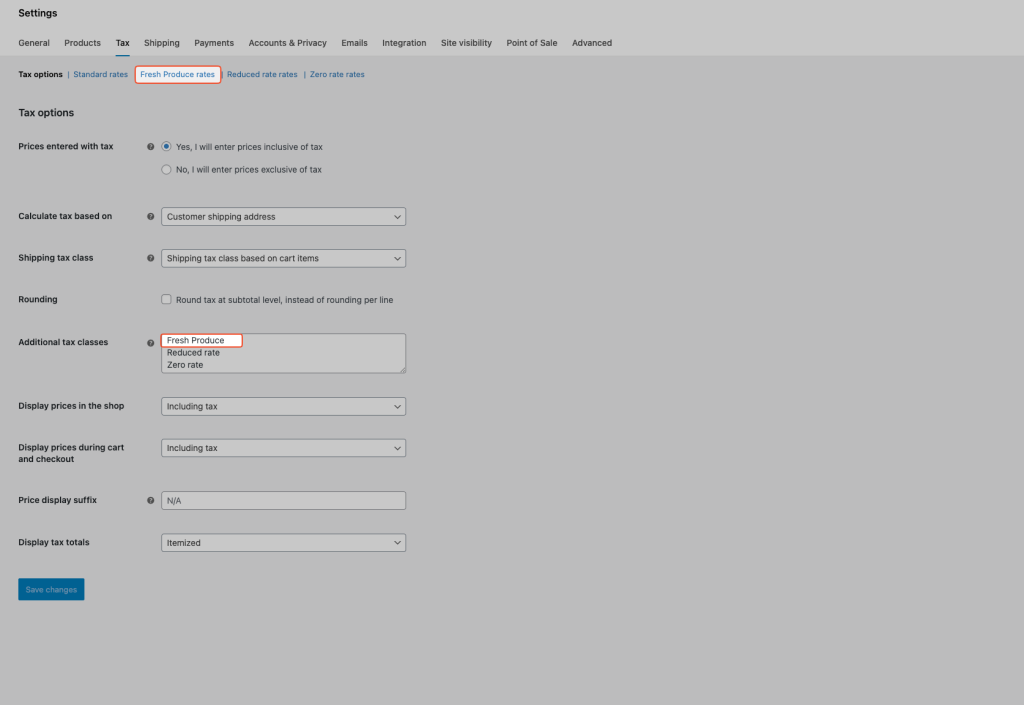

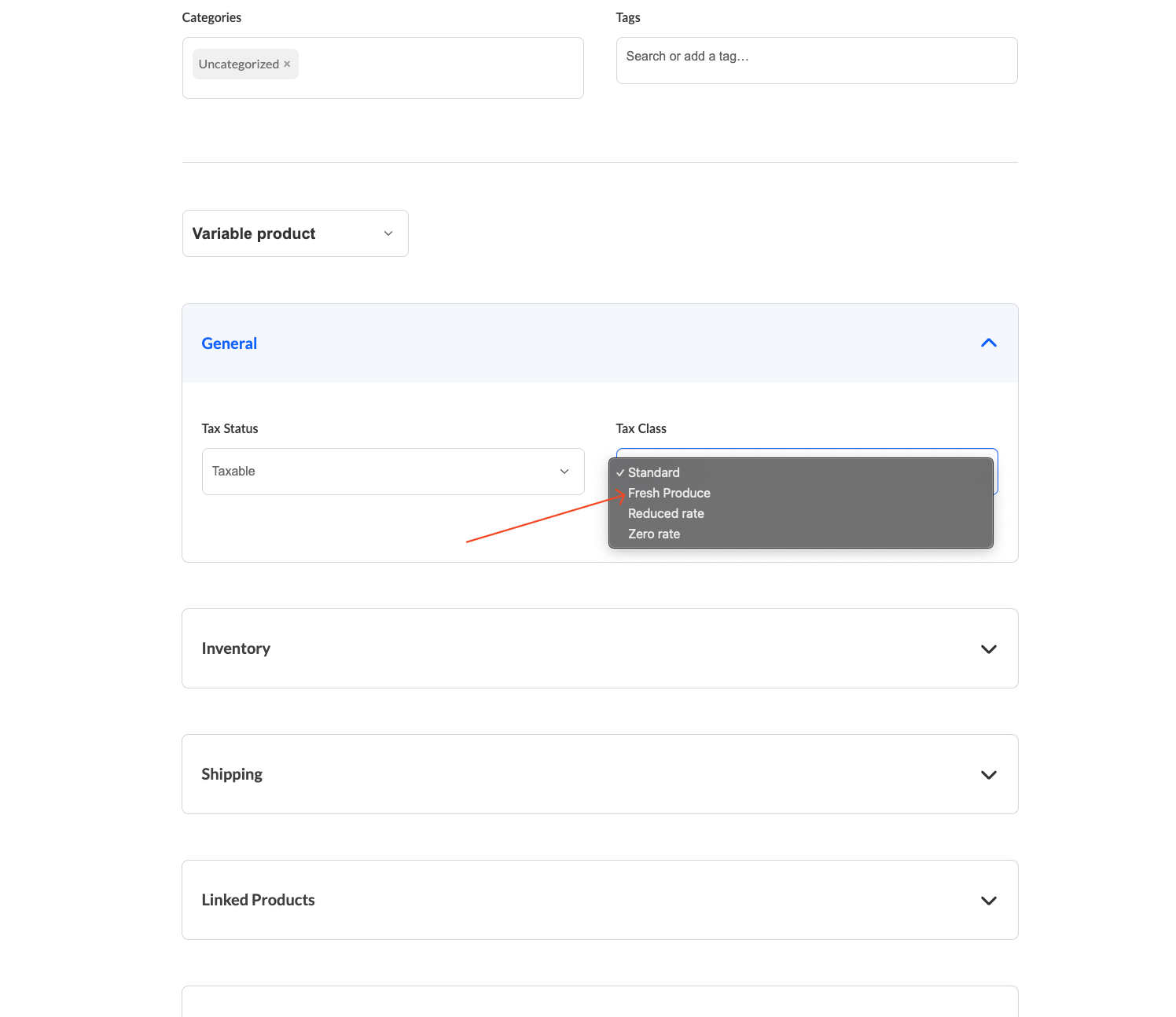

Tax Classes

Sometimes, different types of products need different tax rates. For example, fresh food may have a lower tax than electronics.

With WooCommerce, you can:

- Create tax classes with specific tax rates.

- Vendors can then apply these tax classes to their products while editing them.

Example:

If you create a “Fresh Produce” tax class with a reduced rate, vendors selling fruits and vegetables can assign this class to their products so the correct tax is applied.